Is Moz in decline?

Once dominating the industry, the SEO SAAS pioneer is losing steam. Monthly traffic estimate from

Once dominating the industry, the SEO SAAS pioneer is losing steam.

Monthly traffic estimate from 2017 to 2023, in millions of visits.

Source: Semrush Traffic Analytics data.

In 2016, most SEO-related searches landed you on the Moz website. I was learning SEO basics from their Whiteboards back then.

Semrush and Ahrefs were chasing the leader, developing their product, and growing the community support.

Seven years later, the situation is totally different.

From the top to third position now

I see more and more evidence that Moz is not keeping up with the competition.

In 2018, both rivals overtook the leadership.

Ahrefs was chasing Semrush, but Moz wasn’t a factor anymore.

In 2021, things went interesting. Semrush became public on NYSE, and iContact acquired Moz.

It was a good chance for Moz to invest in the product re-engineering and return to the race.

However, time showed that it wasn’t the plan for investors.

Ahrefs continued to grow substantially in a bootstrap mode.

Semrush utilized $200M accumulated from investors to skyrocket their R&D and marketing, increasing distance from Ahrefs.

Moz was losing the market share and traffic to contenders.

This is how things changed over time:

| Monthly Traffic | Jan 2017 | Nov 2023 | 6 years change |

|---|---|---|---|

| Moz | 3.6M | 2.5M | -31% |

| Semrush | 2.8M | 17.4M | 521% |

| Ahrefs | 1.7M | 10.3M | 506% |

Source: Semrush Traffic Analytics data.

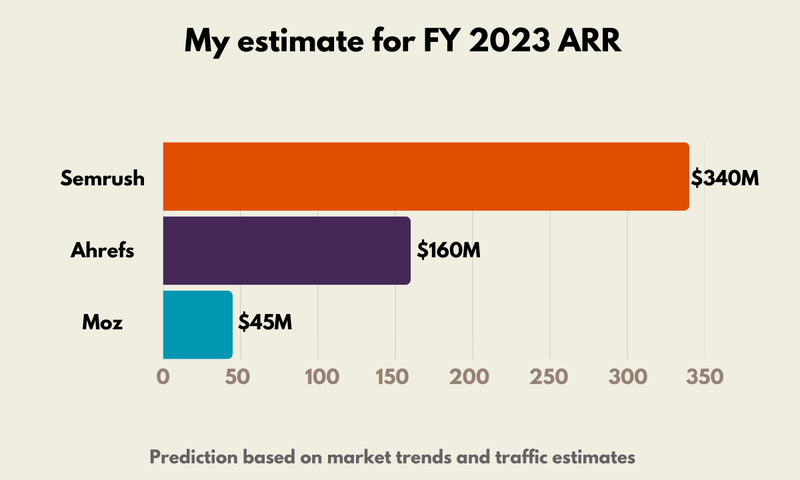

Based on the publicly available data Moz’s ARR estimate was $70M for 2019, Ahrefs ARR for the full year 2021 “just crossed $100M” and Semrush FY 2021 ARR was at $213M.

Taking into account the latest Semrush reporting, market conditions, and traffic trends, my estimate for FY 2023 ARR will be the following:

Semrush – $340M

Ahrefs – $160M

Moz – $45M

(Update 04/26/2024: Semrush clocked in $338M ARR figures for FY2023. Ahrefs and Moz data for FY2023 is not available in the public domain yet).

Stagnated functionality and product features

Besides traffic issues, we haven’t seen any exciting product releases from Moz for quite a while.

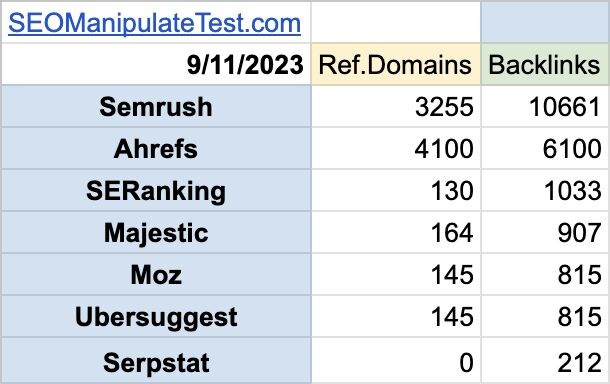

Moreover, my recent research about Domain Authority metrics suddenly discovered a potential decline in Moz functionality. It turns out that Moz’s backlink discovery speed is lagging behind most competitors, not only Ahrefs and Semrush.

Here’s one example:

Number of domains and backlinks discovered during the first week of the experiment.

Source: My Authority Score research.

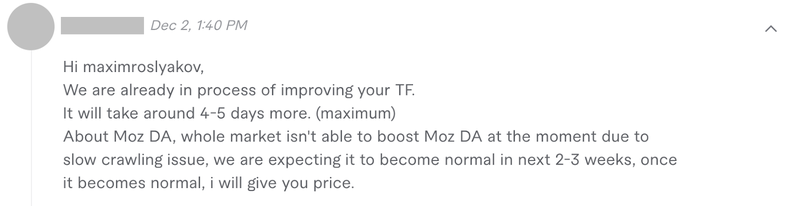

The issue was confirmed by several Fiverr freelancers who earn money by building backlinks to tamper with the “domain authority” metrics. Let me quote them here:

Let me translate it into simple English. Moz’s crawling speed declined to the extent that it just doesn’t discover most of the backlinks created.

Based on our data, this issue has existed for at least five weeks already. We started our research in October 2023. It’s early December now, and the slow crawling is still there.

This slow crawling can signify a cost cut if it’s not a temporary technical issue.

Let me clarify this.

Crawling capabilities are the bread and butter of SEO software vendors. They provide a lot of data for many SEO tools to function properly.

But it’s one of the highest cost centers at the same time. You cannot replace raw crawling data with intelligent algorithms or AI assumptions.

You should constantly crawl through tens of millions of websites and index billions of pages. There’s no cheap or easy way to do it.

Both market leaders are spending tens of millions annually on their servers.

Taking into account the growth rate, Ahrefs server infrastructure costs for 2022 were nearing $20 million. I assume Semrush is spending a similar amount.

Ahrefs infrastructure costs

Source: Ahrefs tech blog

This amount is growing proportionally because millions of new sites appear yearly, and content creation is skyrocketing thanks to generative AI adoption.

Ahrefs and Semrush can bear such costs – they have enough cash, and their revenues are growing aggressively.

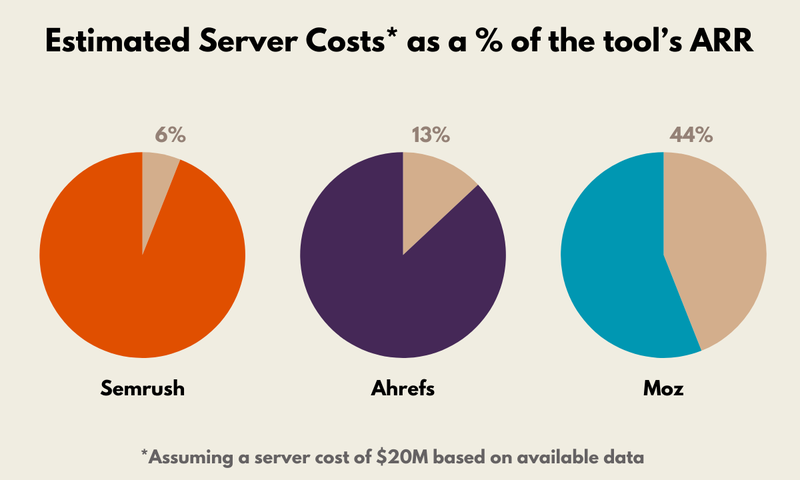

$20 million is less than 6% of Semrush ARR, nearly 13% of Ahrefs ARR, but 44% of Moz ARR estimate.

I don’t think Moz or any other smaller competitor can afford this price tag for high-quality crawling data.

So, I assume that Moz has decided to reduce its crawling power to cut costs.

If true, it may help them improve this year’s bottom line but can lead the company downward.

Cutting server costs can prove costly in the long run

Less crawling power will decrease the data quality, which may drive away more users and further reduce the revenue.

It may also push business users and partners to switch to alternatives.

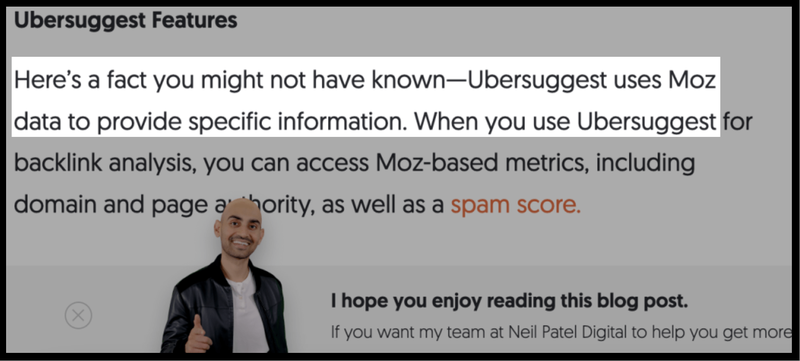

Many business partners use Moz API to source data. Ubersuggest, for example, relies on Moz backlinks data.

Source: Neil Patel blog

With Moz cutting costs and reducing data quality, these business partners can switch to other alternatives. Bringing the revenue further down.

Less revenue will require management to cut costs even more, and the cycle will continue.

Ultimately, the company may pivot its business model, closing or selling the business to the strategic partner.

Stay tuned for more updates:

Max Roslyakov

Founder, Xamsor