Semrush is Stepping on the Enterprise SEO Field

In May 2023, I spotted an interesting data point during the Q1 ‘23 Semrush (NYSE:

In May 2023, I spotted an interesting data point during the Q1 ‘23 Semrush (NYSE: SEMR) investors call.

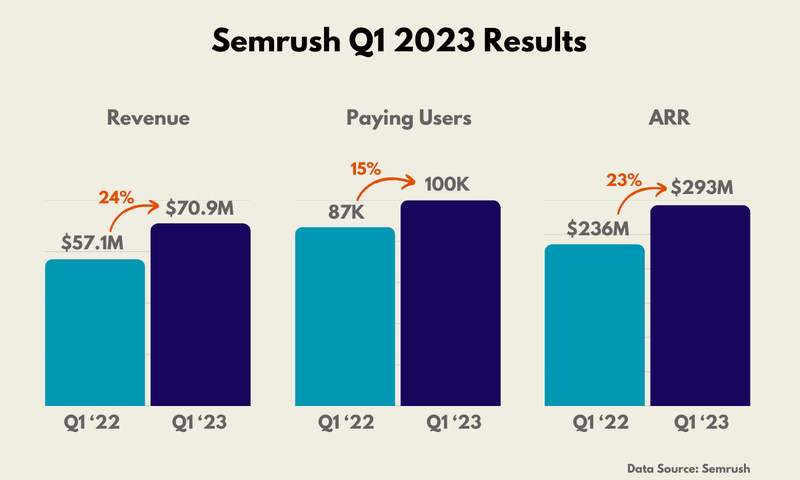

The first-quarter revenue was reported at $70.9 million, up 24% year-over-year. The number of paying users grew 15% YoY. Number of customers spending over $10,000 is growing by over 45%.

Let me break it down:

- The revenue growth of 24% was much higher than the number of users growth of 15%. This means that the average subscription cost per user has grown.

- The number of users paying over $833 per month ($10,000/year) is growing above 45% – more than three times faster than the user base in general.

Semrush has always been SMB-heavy

Here is why it captured my attention: Semrush historically sold to SMBs. $800+ per month is not their “typical” customer.

The average paid user spends $236 per month for the Semrush subscription.

This check may not involve any sales effort whatsoever. Users simply visit your website through marketing channels and make a purchase using their credit card, much like any other online shopping experience. Additionally, they won’t expect customized features or a dedicated support manager.

On the contrary, servicing the enterprise customers is expensive:

- The enterprise selling cycle can take salespeople 6 to 18 months of outreach, follow-up, presentations, etc.

- After you sell, the integration process will often be custom and require some help from the developers.

- Then, you need to pay the dedicated support staff who will know the specifics of the exact customer.

You just can’t afford all this workforce if you sell a $236/month product.

For comparison – the only publicly traded competitor – Similarweb (NYSE: SMWB), earns $4,250 / month from the average subscription. So, their revenue per user is 17 times higher.

That’s why every time investment funds asked me about Semrush’s perspectives on conquering the enterprise SEO market, I was very skeptical.

Now, $10,000 / year customers growing above 45% YoY are telling a different story. So, I’m not that skeptical anymore. Semrush seems to be getting more and more clients from the enterprise cohort.

Top accounts increased their spend

I wasn’t the only person who spotted this information.

James Heaney from Jefferies asked a question:

“Just if you could elaborate more on your comment around the number of customers paying over 10,000 growing over 45%, just how much of that was adding new clients at a higher average selling price versus up-selling customers into new into the higher-priced tiers?”

Eugene Levin – President of Semrush – answered:

“… in terms of how people get into this bucket, I would say the normal path is going to be through upgrade.

… people would buy something and then eventually get into these higher-tiers or buying more. I would say that’s majority of those cases.”

So basically, most top-tier accounts grew organically, increasing their spending over time. They weren’t using any enterprise-dedicated product.

New Enterprise Product

Three months later, in August 2023, during the Q2 ‘23 reporting call, Brian Mulroy – CFO of Semrush, mentioned:

“We’re launching our enterprise product in the second half,”

Meaning H2 ‘23.

Finally, a few days ago, Semrush quietly published a teaser for their Enterprise product.

“Take charge of online visibility at lightning speed with automated workflows and gain access to a private network of experienced SEO consultants—only with Semrush Enterprise.”

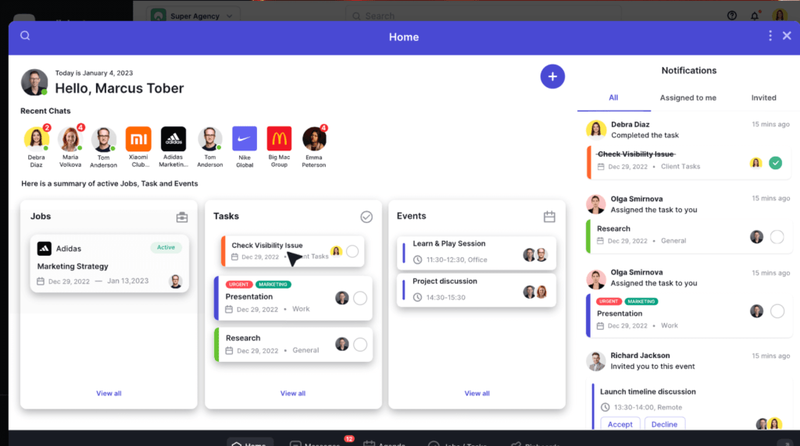

I knew Semrush hired Marcus Tober as SVP of Enterprise Solutions in early 2022, but I’ve never seen any follow-ups. Now I see them!

To summarize

- The highest-paying cohort is growing three times faster than the general user database. It was outperforming even without a product designed for enterprise users.

- There are apparent signs of the internal team aiming to develop this cohort.

- The dedicated product designed for enterprise customers is coming soon.

Only time will tell if Semrush will succeed in the enterprise sector. Companies like BrightEdge, Conductor, and Similarweb have led this market for a while. Now, they will face new competition from Semrush, the leader in the small business market.

Max Roslyakov

Founder, Xamsor